7 Days 7 Lessons #8

- Lesson 1: Health Benefits of Olive Oil (Health)

- Lesson 2: Should you buy a home or rent instead? (Finance)

- Lesson 3: The Compounding Effect of Delaying Your Wants (Finance)

- Lesson 4: The Dead Investors Anecdote (Finance)

- Lesson 5: Enjoying the Journey + Achieving your Goals = Happiness (Happiness)

- Lesson 6: The Difference Between a Want and a Need (Finance)

- Lesson 7: Buying a Car: A Common Financial Mistake (Finance)

7D7L #8 ended up being a bit finance heavy. However, I touch on a lot of controversial topics so it'll be a fun one!

Health Benefits of Olive Oil

Adding a healthy amount of Olive Oil to your diet is recommended and provides plenty of health benefits.

I was having dinner at an Italian place today, and it was 10/10. If you ever have the chance of going to Picolino in Liverpool, I'd highly recommend it, especially if it's with good company.

Either way, I ended up talking about how a lot of Mediterranean countries love their olive oil, and I wonder if their diet is a big reason as to why most Mediterranean countries have a higher life expectancy than the rest of the world, even compared to the USA and the UK.

I've recently heard that olive oil is good for you, so I decided to do some digging to see its health benefits and summarise it in a blog post.

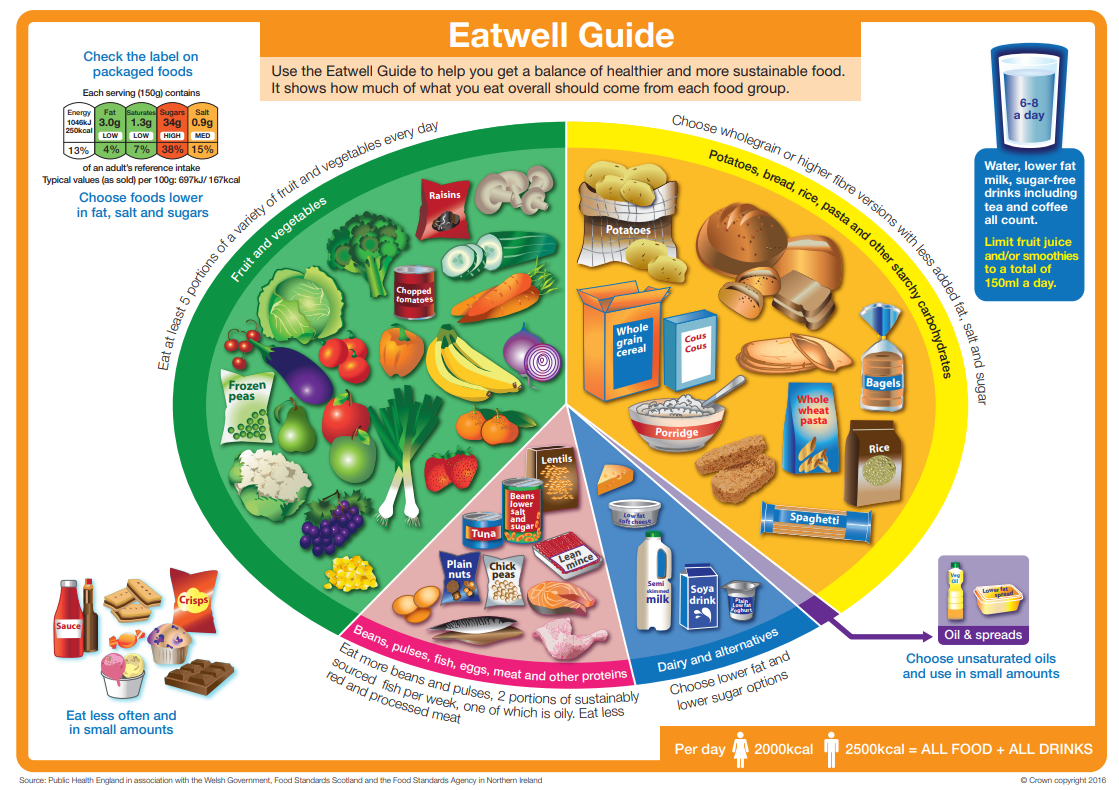

Just before we get into things, we even see oil listed as a requirement for a healthy diet per the Office for Health Improvement and Disparities.

Right, so what are the health benefits of Olive Oil?

- Great Fat Makeup - The makeup of the fats in olive oil is very good. Around 10% is polyunsaturated, such as omega-6 and omega-3 fatty acids, and around 70% is monounsaturated fat, which has possible links to reducing inflammation and oxidative stress, and may even have beneficial effects on genes linked to cancer.

- Full of Antioxidants - Coffee and Green Tea are great for you because of the antioxidants inside the drink. Well, olive oil is loaded with tons of it too. Antioxidants have plenty of health benefits, which can be found here.

- Lower heart disease - Studies show that olive oil improves your healthy cholesterol (HDL) and lowers blood pressure, one of the biggest reasons for heart disease.

- Weight control - Studies show that olive oil encourages weight loss.

- Control Type 2 Diabetes - Studies show olive oil can help control type-2 diabetes by lowering blood sugar levels.

A good article on this by Healthline suggests many more health benefits, but I decided to summarise the most important ones with good amounts of research backing these benefits.

Idon't know about you, but I've always been told oil is unhealthy, especially in fast food restaurants. Now, that's not to say these restaurants don't overdo it, but it does show the risk of just villainising something.

Olive oil and other oils, in fact, are quite healthy for you and recommended by most health organisations. It might be expensive, but maybe it's worth the benefits it brings?

TLDR: Olive oil provides antioxidants, improves type-2 diabetes, encourages weight loss, and offers many other benefits. Simply by adding a small amount of it to your diet.

Should you buy a home or rent instead?

Are you buying a home because you want to, or because others are telling you to?

I've always been told that I should buy a house when I can. I mean, it becomes YOUR house after paying it off, and who wouldn't want to be in the booming UK property market?

That was going to be my primary financial goal, until I heard Robert Kiyosaki talking about how your own home is not an asset; in fact, it's a liability. This is such a hot take, and I wanted to learn more about it. I promptly bought Rich Dad Poor Dad and began reading it.

The main message he brings in the book regarding a house is that an asset brings you money, a liability takes money out of your bank account. A personal home does the latter. He's not against owning homes; that's how he made most of his money, but he only ever bought a personal home, with the passive income he was generating, and he treated it as a liability.

Anyways, this book gave me the curious mind to really look into whether owning a home for myself is a good idea. After more and more research into the topic, a lot of the most financially literate and wealthy people I've come across have all made one thing clear. A personal home is not always a good investment.

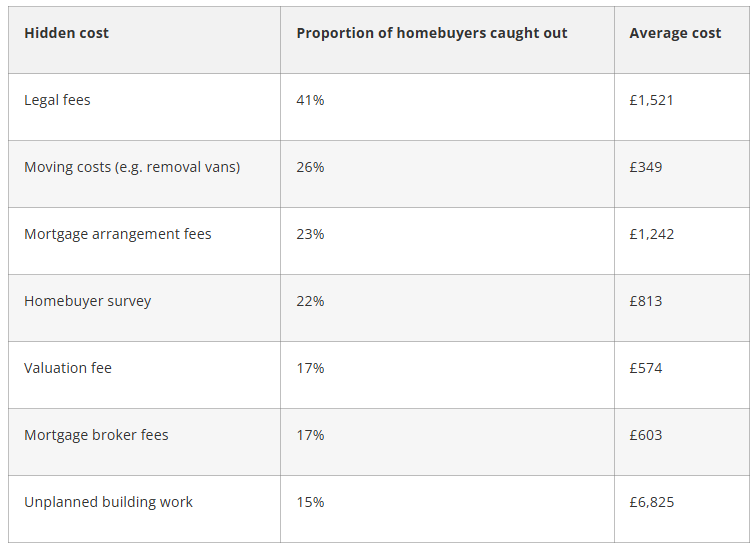

Firstly, buying a home comes with a ton of unexpected costs. New research by Compare The Market highlights this.

If you add up the average of all the unexpected costs, it reaches nearly £12,000. That is quite a large amount of money just being spent on buying a home, which isn't going towards the actual home.

I actually want to highlight the unplanned building work category. I was watching a podcast by DOAC that had JL Collins, author of The Simple Path to Wealth, as a speaker. In it, he highlighted that he has NEVER met a home buyer who said, "I don't want to do any renovation". In fact, if you buy a house, you're expected to do some refurbishing, to turn it into a home, and not just leave it as a house. As you can see, it starts to become obvious that a personal home is turning more and more into a liability.

I would highly recommend watching a video by Damien Talks Money, a personal finance YouTuber who made a video answering whether you should buy or rent in the UK in 2025. It goes into a lot of depth and gives you a really good baseline for understanding whether you should buy or rent.

Also, in the video, he does mention a buy or rent calculator that he provides for free; however, it misses a few things. One calculator that is quite good is the SmartMoneyTools Buy or Rent Calculator, as it covers the things that Damien's calculator misses.

Some other things that I think are important to think about include the fact that homes are a necessity; everyone will always need one, but that also means supply is bound to increase. Therefore, if the number of houses in the UK increases, but the UK is expected to have more deaths than births in 2026, this suggests that demand will begin to shrink, and supply will continue to increase. Whenever you see that in economics, you can expect a decrease in the price of the good, especially if it is a necessity. To be clear, this doesn't factor in immigration, so a decrease in population may take longer to happen.

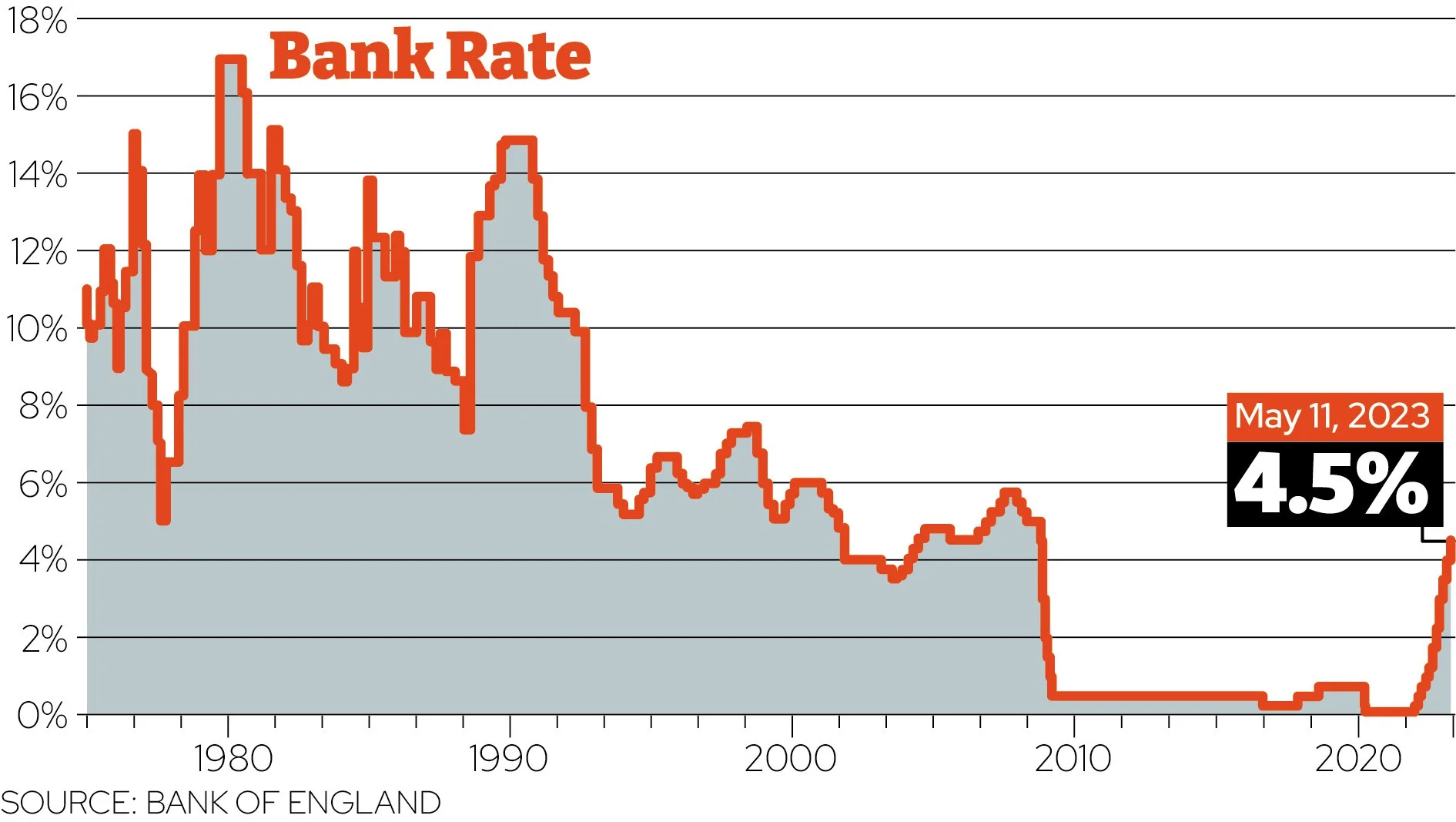

Furthermore, if you look at the current interest rates, they are quite high when compared to the short-term, but quite modest when compared in the long-term.

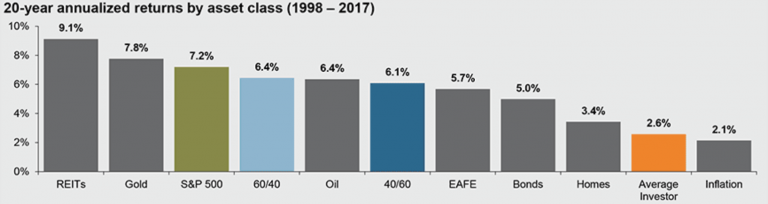

Lastly, I want to highlight a case study of opportunity cost relating to home buying. I mentioned this in 7D7L #4. But basically, someone bought a house in London for £550,000 with a £50,000 deposit in 2017. The value of the property went up 10%, but the value of the S&P 500 during the same period of time went up by 93%. This is an example of another one of the lessons JL Collins talks about, that money invested in a personal home is sitting ideally, not making any money. He would rather that money be working for him.

Now, there are, of course, plenty of examples of homes increasing in value over time in the UK, but I want to remind you again that a home is a necessity. In the long run, an increase in the price of a house doesn't make much sense. Would you expect the price of water to increase dramatically? Of course not, because there is plenty of supply, and I think at some point, we would reach that, but that would be in the distant future.

Lastly, I want to leave you with an article talking about renting vs. buying. In the article, it states that "The main upsides of home ownership include security, freedom and financial control" and that home ownership can come with a lot of financial drawbacks. But it does highlight that "In the short term, renting can be cheaper; however, when interest rates are low, homeownership can prove cheaper"

One final point I want to make is that personal homes do become a good investment if it brings you peace of mind and if you live in them for a longer period of time. This has been the most consistent advice I've seen when doing this research. Everyone I've read on or watched a video from has consistently made this point, and it definitely makes sense.

In this post, I jump all over the place, giving points for and against buying. I did that intentionally to highlight that there are plenty of reasons to buy and not to buy. My goal is for you to make a more conscious decision rather than making a decision that everyone else is telling you to make.

To be clear, I've come from a background where my parents have bought a home, and it was a massive financial burden. However, I definitely do see the upsides to it, too.

I also want to be clear that I haven't done this research as a hypothetical and "I don't know what I'm talking about" because I'm not in a position to buy. I am in a position to buy, which adds some more credibility to this post, and the decision I have made is not to buy.

TLDR: Buying a house is a much more nuanced topic of discussion than it is typically talked about. The biggest benefit of buying a home is the peace of mind it brings you, but the biggest drawback, especially in the short-term, comes from its financial burden.

The Compounding Effect of Delaying Your Wants

If you can, delaying a purchase is a massive financial game-changer.

Whenever I'm making a financial decision, I ask two questions:

- Is this a Want or a Need?

- If it is a want, I then ask, how long can I push back the time of purchasing it?

There are two main reasons why delaying a purchase can make a lot of financial sense.

- The cost of the item shrinks relative to your net worth as time goes by.

Age | Pension wealth (£) | Property wealth (£) | Financial wealth (£) | Physical wealth (£) | Total wealth (£) |

|---|---|---|---|---|---|

25 to 34 | 16,728 | 24,741 | 5,360 | 19,253 | 66,081 |

35 to 44 | 63,724 | 80,249 | 24,931 | 26,709 | 195,612 |

45 to 54 | 173,131 | 126,969 | 34,347 | 29,638 | 364,086 |

55 to 64 | 305,689 | 172,032 | 62,127 | 35,190 | 575,038 |

Above is a table showing the average net worth of individuals in the UK. There's a clear pattern here. The older you become, the bigger your net worth. This matters because buying a £15,000 car when you're 25 vs. when you're 35 will tank your net worth at different levels. If you're 25, a £15,000 car is about 25% of your net worth, whereas if you're 35, a £15,000 car is around 13% of your net worth.

This is important because now this purchase will not cripple your living standards if your life takes a U-turn.

- Every purchase has its own opportunity cost.

As mentioned in another 7D7L blog post I wrote on Opportunity Cost, spending your money now when it could be used to make money somewhere else is something you have to consider when making a purchase.

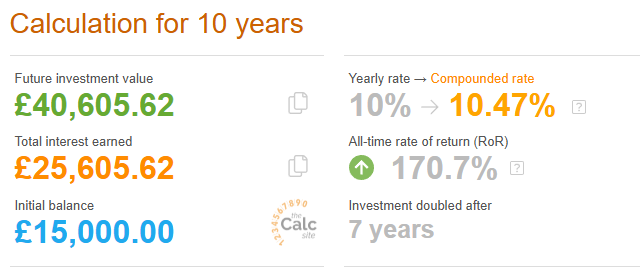

Taking the same example as above. If I bought a £15,000 car when I was 25, firstly, I might be taking out a loan to pay for it; secondly, I'm losing out on the potential of investing it in the stock market.

However, if I waited until I was 35 and therefore let my £15,000 sit in the S&P 500 for 10 years, I could've made a return of £25,000 profit, enough for me to buy two of the same cars!

That's why the two questions I ask myself whenever I want to buy something work, because they can identify what type of item it is (need or want) and whether I could live without it for a small period of time to improve my financial position.

Building up wealth doesn't come about overnight. It's the hard work of days, months, and years of small changes that lead to massive growth.

I urge you to try my methodology. With the hypothetical money you incur from good financial decisions, write down the category (need or want) and write down how long you can delay it by. Then see what that looks like after doing the maths using a compound interest calculator.

TLDR: Delaying a purchase is a good financial decision because it can improve your financial position by not draining as much of your net worth, but also by allowing the delayed payment of the item to work for you.

The Dead Investors Anecdote

Stop thinking you're some financial genius at investing; more often than not, you are just hindering your financial future.

The dead investor anecdote is popular amongst the financial community. It essentially quotes a study conducted by Fidelity, where the performance of customer accounts was analysed to see which accounts performed better. The findings supposedly revealed that the best-performing accounts were the ones that belonged to dead investors or accounts that were completely forgotten about.

Unfortunately, the mysterious research paper cannot be found, and is probably more of a legend than reality. However, the message that this anecdote is conveying is still very true.

Research shows that around 3% - 20% day traders successfully make a profit. Whereas the buy-and-hold strategy has consistently performed well, and is chosen by most pension schemes, government pensions, etc.

To be clear, I don't think allocating a small proportion of money to riskier investments is wrong. However, I would suggest this is money that wouldn't impact your future if you lost it. After all, this is how most Venture Capitalist firms make their money. According to a Cambridge study, 90% of VC profits come from 10% of investments made. VC is just a power law industry.

Nearly all of the wealthiest people I've watched have always said you should keep investing simple and you should invest in an ETF and let your money work for you. This advice seems to line up with the dead investors anecdote.

It's incredibly hard to find which business will win in the long-term; however, by investing in an ETF, you remove the need to win in this guessing game, and instead, you simply need to choose the right market.

TLDR: People who touch their investment accounts less often are more likely to receive a greater return than those who touch their accounts more often.

Enjoying the Journey + Achieving your Goals = Happiness

A simple formula for happiness.

I've been reading The Alchemist by Paulo Coelho, and it's been a fun book so far. It's highly commended, and its popularity, although small at first, blew up after presidents, celebrities, and normal people, like you and me, started recommending it.

One of the lessons I learned was that happiness isn't achieved by just achieving goals, nor is it achieved by just enjoying the journey. It's a mixture of both that leads to happiness.

I set myself so many goals, sometimes, I forget the reason why I'm doing it, and I default to, "I'm going to be happy when I achieve this goal". If you've ever had this thought, you soon would have found that this never happens. We have an impressive desire to just keep wanting more, and therefore, achieving one goal will never satisfy us. We are undeniably greedy, especially when it comes to achieving happiness.

However, this doesn't mean that having goals in life is worthless, because I too can say that just enjoying life as is, and making no progress, is detrimental to your happiness.

For example, if I told you to just do the same thing in your life, every day, and to never stop doing that, you would be incredibly unhappy. That's because happiness also comes from spontaneity, and if you have no goals to chase, you also ensure there's no chance of spontaneity.

You cannot just live life with no meaning. That's taking your humanity away, and I can guarantee you, you don't want that.

Below is an extract of one of the parables taught in the book:

“The wise man listened attentively to the boy’s explanation of why he had come, but told him that he didn’t have time just then to explain the secret of happiness. He suggested that the boy look around the palace and return in two hours. “‘Meanwhile, I want to ask you to do something,’ said the wise man, handing the boy a teaspoon that held two drops of oil. ‘As you wander around, carry this spoon with you without allowing the oil to spill.’

“The boy began climbing and descending the many stairways of the palace, keeping his eyes fixed on the spoon. After two hours, he returned to the room where the wise man was. “‘Well,’ asked the wise man, ‘did you see the Persian tapestries that are hanging in my dining hall? Did you see the garden that it took the master gardener ten years to create? Did you notice the beautiful parchments in my library?’ “The boy was embarrassed, and confessed that he had observed nothing. His only concern had been not to spill the oil that the wise man had entrusted to him. “‘Then go back and observe the marvels of my world,’ said the wise man. ‘You cannot trust a man if you don’t know his house.’

“Relieved, the boy picked up the spoon and returned to his exploration of the palace, this time observing all of the works of art on the ceilings and the walls. He saw the gardens, the mountains all around him, the beauty of the flowers, and the taste with which everything had been selected. Upon returning to the wise man, he related in detail everything he had seen. “‘But where are the drops of oil I entrusted to you?’ asked the wise man. “Looking down at the spoon he held, the boy saw that the oil was gone. “‘Well, there is only one piece of advice I can give you,’ said the wisest of wise men.

‘The secret of happiness is to see all the marvels of the world, and never to forget the drops of oil on the spoon.’”

As the wise man said, the secret of happiness is to enjoy the journey, but to never forget your goal.

The quicker you can adopt this mindset, the happier you will be in life. Focusing solely on one is not good enough. You can't just focus on the goals, because you will never be satisfied. But you also cannot just focus on enjoying the journey, because you will never fulfil your meaning.

I think we are in a meaning crisis. I've asked many people what their goal for life is, and the answers are just shocking. They simply don't know. At some point, we've stopped dreaming, we've stopped believing we could do anything, and let our circumstances define who we are. The sooner you recognise this, the sooner you'll have control over your life again.

TLDR: Achieving a goal brings fleeting happiness, but just enjoying life and staying still in your position is throwing away your purpose for life. A mixture of both is what allows for true happiness.

The Difference Between a Want and a Need

One simple lie is causing you to lose money unnecessarily.

What's the most important thing to get right in personal finance? Is it investing? What about buying a property? Or maybe even increasing your salary?

If you said one of the above, or in fact anything else, you were wrong. The most important thing to nail in personal finance is budgeting. If you don't steward a salary of £30,000, you won't steward a salary of £100,000. If you're reckless with small amounts, you'll be reckless with big amounts.

One of the most important budgeting tips I've learned in recent years is to clearly identify the difference between a want and a need. Unfortunately, we tend to conflate wants with needs, and this is an incredibly expensive decision.

I'm very strict with it personally. A need is something you cannot live without, or something that, if removed, would reduce your income. A want, on the other hand, is something that you can live without, or can be removed without impacting your income.

Yes, that means your hobbies, your snacks, your takeaway, your unnecessary bus trips when you could be walking are all wants. It's important to make these distinctions because if you don't, you're going to continue collecting more and more "needs", and eventually you're making £100,000, and you're still spending almost all of it on "needs". Your lifestyle has become expensive alongside your budget, and you're technically not in a better position.

To be clear, I am not insane. I spend things on wants; otherwise, what's the point of earning more money? However, I am honest about what is a want, and what is a need. When you can recognise this, you can also recognise what you can cut from your budget in order to improve the amount of savings you're making.

Now that's not to say that your needs are justified in spending either. For example, three things you can cut your costs on from your needs category include:

- Utilities - Recontracting a more favourable bill. Use Compare The Market, it’s great for this.

- Groceries - Look at buying cheaper ingredients from budget grocery stores.

- Rent - Look at moving to a different place that can reduce your rent.

Either way, labelling your spending correctly is critical to having a good budget. Otherwise, you will keep collecting more and more useless purchases that do nothing but hinder your financial future.

I'm not here to demonise wants. But I am here to convince you to be truthful with yourself. It's okay to say the money you spend on games is a want, but that doesn't mean you have to cut it out of your life; it does mean if you need money, it should be one of the first things to go.

Reducing my wants has probably incurred savings of around 5% of my spending. My quality of life has not decreased; in fact, it has gone up simply because I'm less reliant on money to make me happy, and I'm buying financial independence more quickly.

TLDR: Most people confuse needs with wants. Although it seems like a small thing, it can compound into lifestyle creep, where even when you're making significantly more money than before, you still have the same leftover cash as before too.

Buying a Car: A Common Financial Mistake

Cars are expensive. Should; you buy one now, or should you push the purchase back?

Before I get into things, if you're a car fan, you can skip this lesson. A car is your hobby; there's nothing I can do that will convince you not to spend money on the car you want and can afford, and that's okay.

So, to give some context, My Fiancée and I have, until recently, disagreed about our car situation. She believed it was necessary for her medicine degree (because most people had one and the majority of her hospitals were miles away), and I said that it wasn't a necessity, it was a want. I reasoned that she could use public transport (albeit it was often unreliable), ask people for rides, or take medical school shuttle buses (albeit not always available), which was significantly more affordable than owning a car outright. I mean, she survived doing this for two years, what's another 3 more? The want for the car she had was primarily a quality-of-life stance (apart from a few exceptions), and we weren't in a position to justify this want for a quality-of-life improvement.

Because of this, I've become very passionate about the car situation. My stance is that a decent minority of car owners don't need their cars and have only bought them because everyone else has one. The money that is saved from not owning your own car can also be used to create financial independence a lot quicker. A lot of my close friends with cars have also agreed with me on this and have underestimated the cost of having a car.

I think cars are necessary when:

- You live far away from everything. For example, living in the countryside.

- You need it for work. For example, you travel a lot, maybe you're a consultant, or maybe you do home renovations, etc.

- Any other reason that is included in the needed definition: Something you cannot live without, or something that, if removed, would reduce your income.

To be clear. If you NEED a car, you NEED one. There's no two ways about it. You can always reduce your cost by changing cars, but the cost savings are marginal compared to if you could sell it completely. However, if you just want a car, I would like to highlight the average cost of owning one.

Firstly is the cost of the car itself. Buying a cheap, decent-condition car can set you back at least £3,000. Of course, this number rises significantly if you want a more expensive car. A lot of the time, when people take a loan out to buy a car, they will often buy slightly higher than what they can typically afford.

Now lets look at the cost of keeping the car in good shape:

- MOT = £40 per year

- Fuel = £120 per month

- Insurance = £1,000 - £3,000, depending on age, job, and location. Per year.

- Road Tax = £195 per year

- Maintenance = £500 - £1,000 per year

- Parking = £20 - £1,000 per year

When we consider all the costs, it starts to rack up quite quickly. I mean, if we just forget about the cost of the car, the operational cost of a car every year at best adds up to £3,195.

Knowing this, ask yourself, can you survive on £3,200 a year, combining Uber, public transport, walking, etc? If you can, maybe you should give up your car and choose the alternatives IF you need the extra money. If you want a car for groceries, it could be cheaper to just order a delivery. If you live in London, a car is rarely needed.

And one thing people completely forget about is the benefits of not driving a car. You don't need to focus! You can read a book, play video games, watch a series, etc.

I'm not here to say that cars are bad and no one should want one. However, I want you to know the negatives of owning one, and be aware that maybe owning a car is simply not needed, depending on your living conditions. Maybe you eventually want one, as I do. Why not ask yourself: "Can I push this back a bit longer so I can better my financial position?

Like most of my writing, I aim to give nuance to topics that are often painted in black and white. When I was younger, I always thought that having a car was necessary. When I compare myself to others, I wish I had a car. But when looking into the cost of owning one, my current state in life simply meant it was going to be used as a luxury, not really for my needs.

I eventually want to buy a car. I love my BMWs, so I might get one of those in the future. However, every day I choose not to buy a car, I am actively committing the money I save to buying my financial independence.

TLDR: Cars are expensive. A lot of people often forget about the running costs for a car. This can be an incredibly expensive mistake and lead to a lot of unexpected expenses. If you can live without a car, I would recommend looking at the savings you could make by not owning one.

Quotes Of The Week

- "Wisdom is not a product of schooling but of the lifelong attempt to acquire it."

― Albert Einstein - "There are graveyards full of people who thought they had more time" – Popular Phrase.

- "You've faced too many storms to be bothered by raindrops" – Popular Phrase.

- "Any fool can know. The point is to understand." ― Albert Einstein